How to Start Neobank in UK & USA – Do you know that the financial industry is revolutionizing rapidly with neobanks leading the way? These advanced banking institutions operate exclusively online and provide a convenient and tech-savvy alternative to traditional physical banks. If you’re an aspiring entrepreneur looking for innovative ways to disrupt conventional finance methods, launching a neobank in either UK or USA may well prove lucrative as well as highly influential.

However, building up your presence while navigating through regulatory complexities requires intricate planning coupled with effective execution strategies. Throughout the process, partnering with an experienced technology provider like Richestsoft can help streamline operations and ensure compliance with regulatory standards, enabling you to launch a successful neobank in both the UK and USA markets.

This comprehensive guide dives into this dynamic world of neo-banking empowering you with insights needed to launch your successful venture in any UK or US market setting.

Comprehending the Neobank Network

Challenger banks or digital banks, referred to as neobanks, vary distinctly from conventional banking institutions in a number of significant aspects:

- Neobanks adopt a digital-first strategy where they solely operate through mobile apps and user-friendly web interfaces to offer all services and functionalities online.

- Neobanks emphasize the importance of a smooth and user-friendly experience for their customers. They pride themselves on having modern designs, uncomplicated functionalities, and clear communication.

- Neobanks can lower their operational costs by not having physical branches, which can lead to reduced overheads. As a result of this cost reduction strategy, customers may benefit from more affordable fees and competitive interest rates.

- Neobanks utilize advanced technology to provide novel functionalities such as budgeting aids, prompt fund transfers, peer-to-peer payments and coordination with financial administration platforms.

What is the reason for launching a Neobank in either UK or USA?

Neobank ventures are attracted to the UK and USA due to their thriving ecosystems, making these regions a prime market for new entrants. The following explains why such areas provide fertile ground for your neobank venture:

- The UK and USA boast considerable mobile phone and internet usage, resulting in a thriving clientele base for digital banking remedies.

- The increasing demand for innovation among customers in these regions is evident, as they possess a strong tech-savvy disposition and are receptive to embracing inventive financial products and services.

- Fintech Regulatory Frameworks: Neobanks in the UK and USA can easily acquire licenses as both countries have established regulatory frameworks for fintech companies.

Key considerations when comparing UK and USA

Although both nations provide hopeful possibilities, significant differences exist.

- The regulatory environment in the UK, managed by its Financial Conduct Authority (FCA), is characterized by a simplified licensing process for neobanks. Conversely, the USA has more intricate regulations that vary depending on specific services provided.

- The UK neobank sector is currently experiencing market saturation due to the presence of well-established players such as Revolut and Monzo. Meanwhile, in the USA, new innovative entrants have opportunities for growth but are facing increased competition from companies like Chime and Current.

- When identifying your target audience, take into consideration their demographic characteristics and financial requirements. In the UK, there is a significant presence of millennials and Gen Z individuals whereas in the USA, you can find a more extensive as well as diverse clientele base.

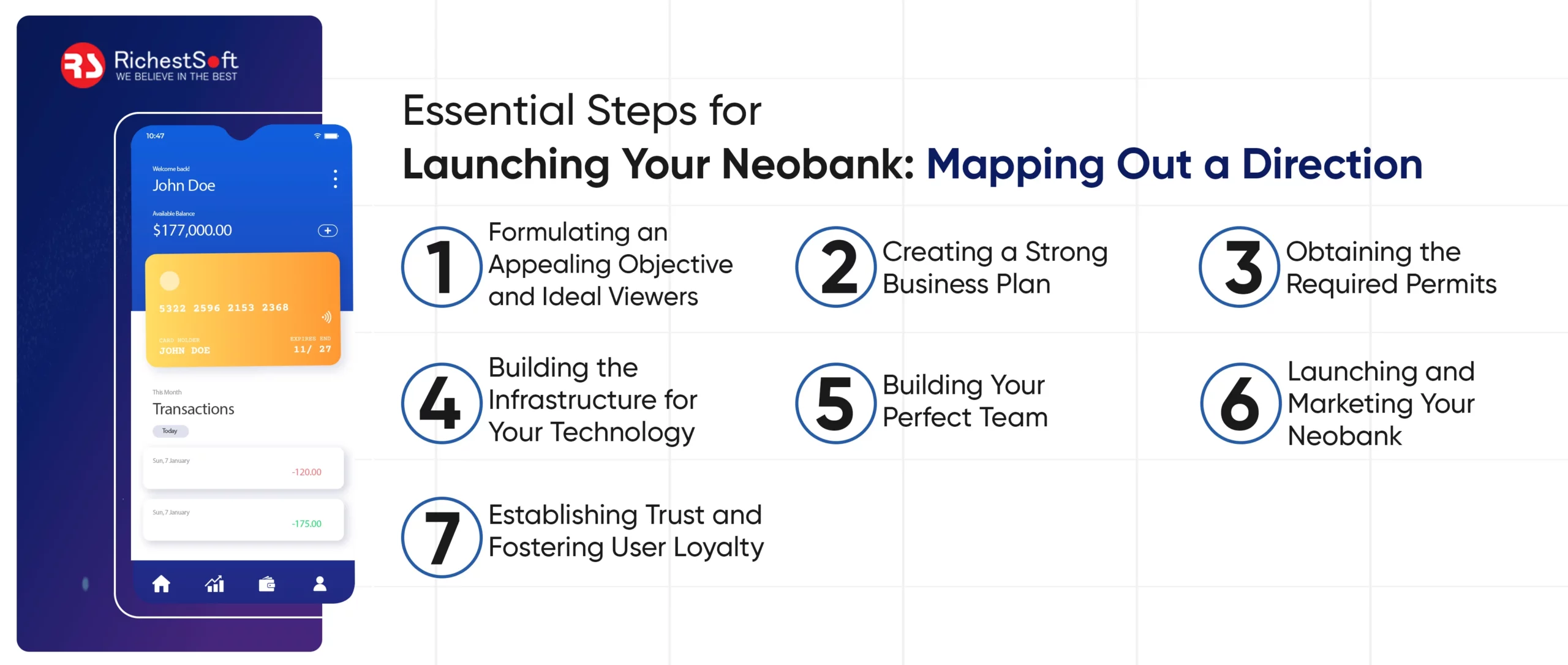

Essential Steps for Launching Your Neobank: Mapping Out a Direction

-

Formulating an Appealing Objective and Ideal Viewers

- Analyze the current neobank market in your selected country to pinpoint any unfulfilled needs or opportunities. Determine what distinct value proposition your neobank can offer that sets it apart from established competitors.

- Identify Your Target Audience: Who do you intend to cater to? Is your focus on millennials, individuals without bank accounts, or a particular market segment such as small enterprises?

- Craft a Compelling Value Proposition: How do you intend to simplify your neobank customers’ lives? Will you emphasize affordable charges, cutting-edge functionalities or concentrate on distinct financial objectives?

-

Creating a Strong Business Plan

- Clearly delineate the fundamental financial services you will provide, including checking and savings accounts, debit cards, money transfers as well as probable investment selections.

- One important aspect to consider is the revenue generation model which involves deciding on methods such as transaction fees, card usage interchange fees, premium feature subscription models or collaborations with financial institutions for income.

- Generate sensible predictions for the initial expenses, running costs and potential income streams of your startup by using financial projections.

-

Obtaining the Required Permits and Adhering to Regulatory Requirements

- In the UK, obtaining an e-money license from the FCA or a full banking license from the PRA may be necessary depending on the range of services provided.

- The regulatory environment in the United States is characterized by greater complexity.

- Depending on the nature of services provided, one may be required to obtain licensure from either the Office of Comptroller of Currency (OCC), Federal Deposit Insurance Corporation (FDIC), or acquire a state-level banking license.

-

Building the Infrastructure for Your Technology

- Develop a mobile application with an easy-to-navigate interface enabling users to manage their finances effortlessly.

- To safeguard customer data and secure financial transactions, it is recommended to incorporate strong cybersecurity measures. Emphasis should be placed on implementing rigorous access controls, regular security audits, as well as optimum data encryption techniques.

- The main objective is to prioritize User Experience by creating an interface that promotes easy navigation, presents information in a clear manner, and enables swift execution of financial activities.

-

Building Your Perfect Team

- Hire individuals who are knowledgeable in the field of financial technology, particularly experts in banking operations, mobile app development and cybersecurity.

- Having a team member or dedicated group to navigate regulatory compliance and ensure adherence to financial regulations is essential for Regulatory Compliance Officers.

- Attention Marketing and Customer Service Experts: It is highly recommended that you focus on forming a robust marketing crew to create brand awareness and draw in clientele. Moreover, it is crucial to set up a customer service division committed to promptly resolving any client inquiries or issues efficiently.

-

Launching and Marketing Your Neobank

- It is recommended to conduct a soft launch and testing with a select group of customers, in order to obtain feedback from users and improve your products or services prior to launching on a larger scale.

- Creating a robust brand identity involves crafting a unique image that resonates with your intended audience and embodies the fundamental values of your neobank.

- The recommended marketing approach involves employing various channels, such as social media advertising, creating valuable content for potential customers to consume and share online platforms, teaming up with well-known figures in the industry who can promote your product or service and collaborating strategically.

- Put Emphasis on Gaining Customers: Create appealing initial promotions and referral initiatives to encourage customers to enroll.

-

Establishing Trust and Fostering User Loyalty

- Make Transparency and Security a Priority: Ensure that your fees, terms, and conditions are transparent to customers. Demonstrate dedication to data security by implementing trust-building measures.

- Emphasis on Customer Experience: Continuously endeavor to improve the user experience through innovative feature additions, exceptional customer service provision, and integration of feedback from customers into product development.

- Developing a Community: Foster a notion of interconnectedness amongst your neobank users by interacting with them on social media, offering educational financial materials, and delivering exclusive perks.

Achieving Success: Primary Factors and Strategies for Long-Term Growth

To excel in the highly competitive neobank sector, adopting a strategic approach is crucial. Here are some critical factors to distinguish yourself from others:

- Specialization involves focusing on serving a specific market segment, such as catering to the needs of small businesses in banking, promoting sustainable finance practices or providing financial services for unbanked individuals.

- Revolutionary elements: Implement financial planning and budgeting AI-based tools, provide gamified aspects to inspire beneficial financial practices or collaborate with Fintech firms for exclusive services.

- Emphasize Financial Well-Being: Offer informative materials or in-application utilities to bolster financial competence and enable clients to make enlightened choices regarding their finances.

Strategies for Sustainable Growth Over Time

- After establishing your operation, contemplate extending your services to other locations across the UK or USA.

- Form strategic partnerships with established financial institutions to enhance the range of financial products and services or amalgamate your neobank platform with other fintech tools.

- Consider strategic acquisitions of smaller fintech firms to access new functions and broaden your clientele, when considering acquisitions.

Making Sustainability a Key Factor: Setting Your Neobank Apart

Sustainability can serve as a strong distinguishing feature for your neobank’s operations and offerings in today’s environment that prioritizes environmental awareness. Some strategies to consider include:

- Collaborate with Environmentally-Conscious Businesses: Provide special perks or price cuts to clients who support eco-friendly establishments via your channel.

- Collaborate with carbon offset providers to enable clients to neutralize the environmental impact of their daily banking actions via Carbon Offset Programs.

- Investment Options for Sustainability: Provide investment offerings that give priority to environmental, social, and governance (ESG) aspects in order to serve clients who desire financial alignment with their principles.

- Showcasing your dedication to sustainability can attract an expanding group of eco-friendly customers and establish your neobank as a responsible finance trailblazer.

Conclusion

To successfully establish a neobank in either the UK or USA, it is imperative to have an organized strategy and a dependable team dedicated to innovative approaches. Adopting a personalized approach that caters directly to customer requirements through advanced technological channels would enable you to provide superior user experiences with utmost emphasis on security and reliability enabling you thrive even amidst constantly modifying financial surroundings.

Only those individuals daring enough for risk-taking coupled with flexibility can enjoy stable growth in finance’s future trajectory of transformation driven by paradigmatic shifts fueled significantly by technology innovations – Will YOU take part?

+1 315 210 4488

+1 315 210 4488 +91 798 618 8377

+91 798 618 8377