Cost Breakdown Of Whitelabel NeoBank App Development – In this comprehensive guide, we’ll unravel the intricacies of developing a Whitelabel Neobank app, offering an in-depth analysis of the associated costs and factors to consider. Whether you’re a fintech entrepreneur or an investor, understanding the financial aspects of building a Neobank app is crucial for informed decision-making.

Join us as we explore the key components, development stages, and budget considerations in creating a successful whitelabel Neobank app. Whether you’re looking to revolutionize the banking industry or expand your financial services, this blog will equip you with the knowledge and insights to navigate the complexities of Neobank app development and make sound investment choices.

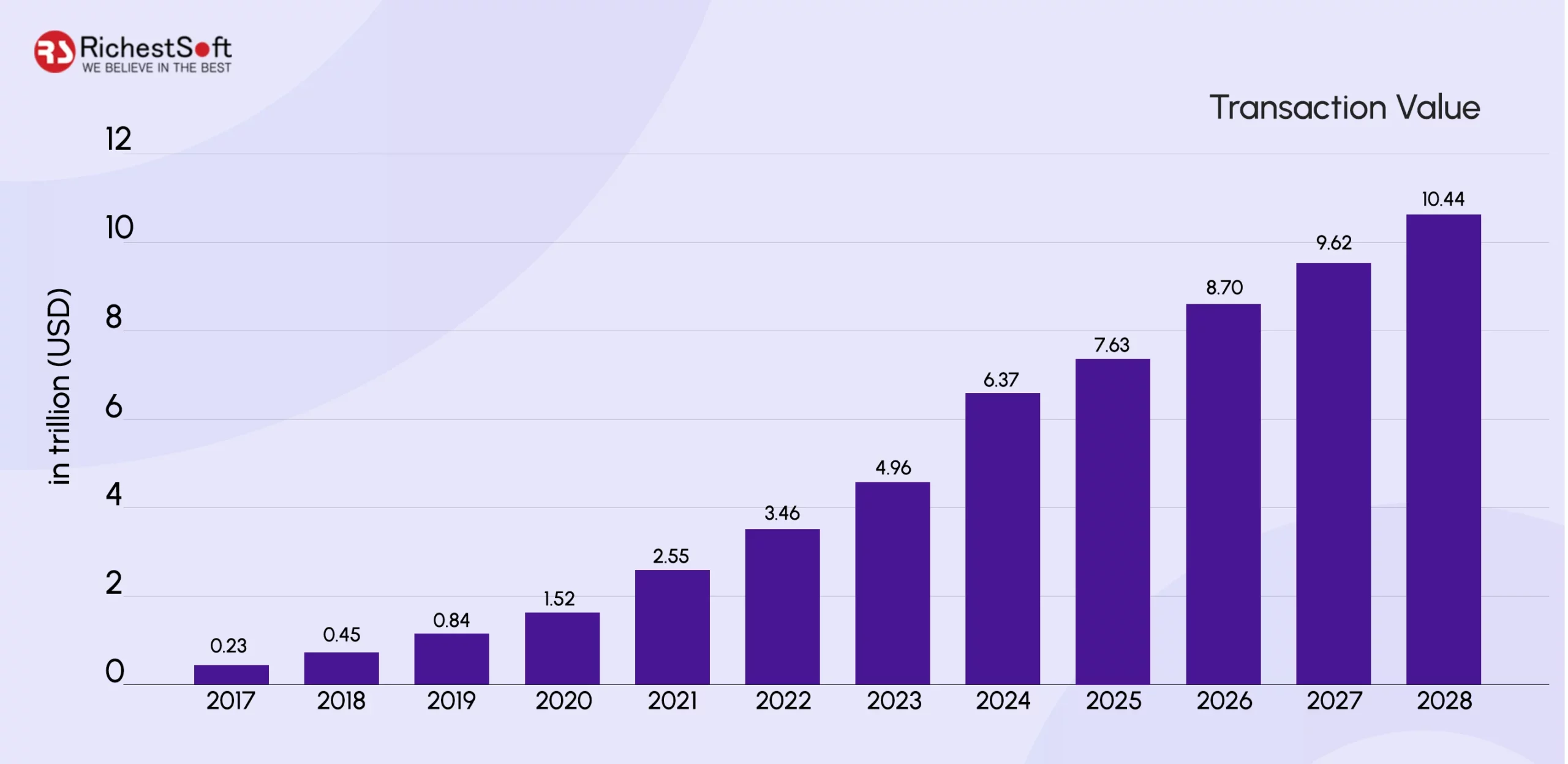

Neobank Market Stats & Trends

Neobank Market Stats & Trends

- The Neobanking market is forecasted to see transactions worth US$6.37 trillion by 2024.

- With an expected annual growth rate (CAGR 2024-2028) of 13.15%, transaction values could reach US$10.44 trillion by 2028.

- By 2024, the average transaction value per user in the Neobanking market is estimated at US$21.11 thousand.

- The United States leads globally with a transaction value of US$1,785.00 billion in 2024.

- By 2028, the Neobanking market is projected to have 386.30 million users.

- User penetration is set to rise from 3.89% in 2024 to 4.82% by 2028.

Cost Breakdown of Whitelabel Neobank App Development

| Cost Component | Description | Estimated Cost |

|---|---|---|

| Development Services | Backend and frontend development | $20,000 - $50,000 |

| Design | UI/UX design | $5,000 - $15,000 |

| Third-party Integrations | Payment gateways, identity verification, etc. | $5,000 - $20,000 |

| Security Features | Encryption, fraud detection, compliance | $10,000 - $30,000 |

| Testing | Quality assurance and testing | $5,000 - $15,000 |

| Maintenance | Ongoing updates and support | $2,000 - $10,000/month |

| Regulatory Compliance | Licensing, legal fees | $5,000 - $15,000 |

| Marketing and Launch | Promotion, app store fees | $5,000 - $20,000 |

| Contingency | Buffer for unforeseen expenses | $5,000 - $10,000 |

The approximate cost to build a high-end white-label Neobank app is between $57,000 – $150,000.

Note: Costs may vary depending on complexity, features, development team rates, and geographic location.

Key Features That Impact Neobank Development Costs

Security Infrastructure

Implementing robust security measures such as encryption, biometric authentication, and fraud detection systems significantly influences development costs due to the complexity and sophistication required to safeguard user data and transactions effectively.

Integration of Financial Services

Integrating various financial services like payments, transfers, loans, and investments into the Neobank app expands its functionality but also increases development costs due to the intricacies of integrating diverse financial systems and ensuring seamless interoperability.

User Interface and Experience

Crafting an intuitive and visually appealing user interface (UI) coupled with a seamless user experience (UX) is paramount for Neobank apps. Investing in UI/UX design and development adds to development costs but enhances user satisfaction and engagement, ultimately driving the app’s success.

Regulatory Compliance

Compliance with financial regulations and standards is essential for Neobank operations. Ensuring adherence to regulatory requirements incurs additional costs for legal consultations, compliance audits, and implementation of necessary measures to meet regulatory standards, thus impacting development costs.

Scalability and Flexibility

Building a Neobank app that can accommodate future growth and adapt to evolving market demands requires scalable and flexible architecture. Implementing scalable infrastructure and designing flexible features incurs higher development costs upfront but ensures the app’s ability to scale and evolve over time without significant redevelopment.

Customer Support and Service Channels

Providing robust customer support through multiple service channels such as live chat, email, and phone support enhances the user experience and fosters customer satisfaction. Integrating comprehensive customer support functionalities into the Neobank app adds to development costs but is essential for building trust and loyalty among users.

Why You Should Invest in Neobanking Business

Accessibility and Convenience

Neobanks offer convenient access to banking services through mobile apps, enabling users to manage their finances anytime, anywhere, without the constraints of traditional banking hours or physical branches.

Innovative Features and Technology

Neobanks leverage cutting-edge technology to provide innovative features such as real-time transactions, personalized financial insights, and automated savings tools, enhancing the overall banking experience for users.

Cost-Effectiveness

With lower operational costs compared to traditional banks, Neobanks often offer competitive fees, higher interest rates on savings accounts, and lower or no minimum balance requirements, making them a cost-effective option for consumers.

Targeted Services for Specific Demographics

Neobanks cater to specific demographics such as millennials, freelancers, and small businesses by offering tailored financial products and services designed to meet their unique needs and preferences.

Agile and Responsive Customer Support

Neobanks prioritize customer satisfaction by providing responsive customer support through various channels, including live chat, email, and social media, ensuring timely assistance and resolution of issues.

Disruption of Traditional Banking

Investing in Neobanking business represents an opportunity to disrupt the traditional banking industry by offering innovative solutions, challenging outdated practices, and driving greater competition, ultimately benefiting consumers through improved choice and service offerings.

Why Select Whitelabel App For Neobank

Time and Cost Efficiency

Utilizing a whitelabel app for Neobanking significantly reduces development time and costs as it eliminates the need to build an app from scratch. This allows Neobank startups to enter the market faster and allocate resources to other crucial aspects of business development.

Customization and Branding

Whitelabel apps offer extensive customization options, allowing Neobanks to tailor the app’s design, features, and branding to align with their unique identity and target audience preferences. This enables Neobanks to differentiate themselves in a competitive market and build brand recognition.

Proven Technology and Stability

Whitelabel apps are built on proven technology frameworks and undergo rigorous testing, ensuring stability, reliability, and security. By leveraging a whitelabel solution, Neobanks can benefit from established technologies and focus on enhancing user experience and expanding their service offerings.

Scalability and Flexibility

Whitelabel apps are designed to be scalable and flexible, capable of accommodating the growth and evolving needs of Neobanks over time. This scalability allows Neobanks to easily add new features, scale their user base, and adapt to changing market dynamics without significant redevelopment efforts.

Regulatory Compliance

Whitelabel app providers often have expertise in regulatory compliance and ensure that their solutions adhere to industry standards and regulations. This alleviates compliance concerns for Neobanks, allowing them to focus on delivering value to customers while maintaining regulatory compliance.

Technical Support and Maintenance

Whitelabel app providers typically offer ongoing technical support and maintenance services, ensuring that the app remains up-to-date, secure, and optimized for performance. This allows Neobanks to rely on experienced professionals for technical assistance and focus on growing their business without worrying about app maintenance.

How Much Time Its Takes To Build Whitelabel Neobank App

The time it takes to build a whitelabel Neobank app can vary depending on factors such as complexity, features, customization requirements, and the development team’s expertise. However, typically, the development timeline for a whitelabel Neobank app ranges from 4 weeks to 12 weeks.

This timeframe includes planning, design, development, testing, and deployment phases. Additionally, factors such as regulatory compliance, third-party integrations, and quality assurance processes can also impact the overall development timeline. It’s essential to work closely with a reputable fintech development partner to accurately estimate and manage the project timeline for building a whitelabel Neobank app.

Why Choose Richestsoft For Whitelabel Neobank App Development

Choosing Richestsoft for whitelabel Neobank app development offers numerous advantages:

Expertise

Richestsoft boasts extensive experience and expertise in fintech development, ensuring high-quality solutions tailored to your needs.

Innovation

We stay ahead of the curve with innovative approaches, leveraging the latest technologies to deliver cutting-edge Neobank apps.

Customization

Our team ensures that every Neobank app we develop is fully customized to meet your unique requirements, ensuring a personalized solution that aligns with your business objectives.

Quality Assurance

Rigorous testing procedures guarantee the quality and reliability of your Neobank app, delivering a seamless user experience.

Timely Delivery

We prioritize project timelines, ensuring prompt delivery without compromising on quality and ensuring your Neobank app is launched on schedule.

Transparent Communication

You’ll be kept informed at every stage of development, with clear and transparent communication throughout the process, ensuring your vision is realized effectively.

Conclusion

Choosing Richestsoft for whitelabel neobank app development ensures you receive a tailored, innovative, and high-quality solution that meets your business objectives. With our expertise, dedication to innovation, and commitment to transparency and communication, we strive to exceed your expectations and deliver a neobank app that sets you apart in the competitive fintech landscape.

Our focus on customization, quality assurance, and timely delivery ensures that your Neobank app is not only functional and user-friendly but also perfectly aligns with your vision and goals. Partner with Richestsoft for a seamless and successful Neobank app development journey.

+1 315 210 4488

+1 315 210 4488 +91 798 618 8377

+91 798 618 8377