Robo-Advisor Platform Development – Use Case & Cost – Want to develop a robo-advisor trading platform but don’t know how much it will cost? Here’s a guide on the platform’s use case and development cost. With the evolving world, technology is also getting advanced day-to-day.

Advanced technology has reshaped the landscape of financial services, covering the way for opportunities and efficiencies. Robo-advisor platforms have emerged as a disruptive force that offers a glance into wealth management.

A robo-advisor trading platform is a fusion of finance and technology that automates the delivery of personalized investment advice. Investing in this FinTech platform will position your business at the forefront of innovation.

Here, we will explore the major aspects related to the robo-advisor platform. In this blog, you will learn the use case and the cost of developing the robo adviser. So, take a look at the following section.

What is a Robo Advisor?

Robo Advisor is a digital platform providing automated algorithm-driven financial planning and investment management with little or no human supervision. It simply asks about your financial situation and future goals.

After that, it automatically uses the data to advise and invest in you. This is usually a digital investment platform that brokerages offer. It helps you to allocate funds to risky assets and risk-free assets.

Robo Advisor analyses and rebalances the portfolio as economic conditions change by adjusting the weight of risky and risk-free assets. AI powers Robo Advisor, which can benefit investors in numerous ways.

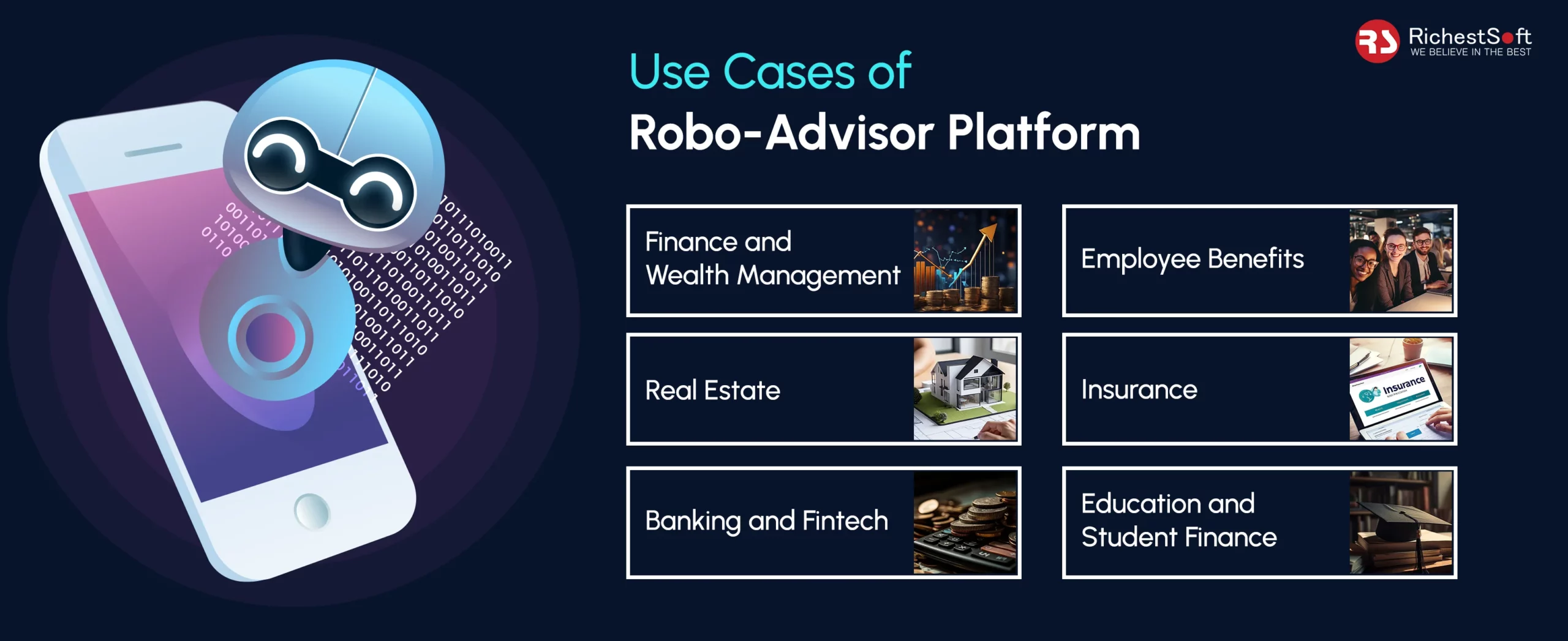

Use Cases of Robo-Advisor Platform

By developing a robo-advisor trading platform, you can offer automated investment management solutions and personalized advice to diverse business applications across different industries. Below, we have listed the white-label robo-advisor platform use cases.

1. Finance and Wealth Management

The finance industry uses the Robo Advisor trading platform to provide automated investment management services. These services can optimize investors’ risk-return trade-offs and automatically operate and rebalance portfolios.

Wealth management firms and financial advisors use Robo Advisor to provide clients personalized investment advice, portfolio management, and financial planning solutions. The software also analyzes client data, risk tolerance, and investment goals and recommends suitable investment strategies and asset allocation.

2. Employee Benefits

Consider developing and incorporating a robo-advisor trading platform to provide employees with personalized investment advice, retirement planning tools, and education resources.

This would empower employees to make informed financial decisions and achieve financial wellness. The platform would also manage the employees’ retirement savings, investment accounts, and other financial objectives.

3. Real Estate

If you invest more in real estate, the robo-advisor trading platform best fits you. Like other digital transformative services, it lets you analyze property investment opportunities and make informed investment decisions.

With this platform, you can get real-time market insights, property valuation tools, and investment tracking features to build and manage real estate more efficiently.

4. Insurance

Although the human touch will remain relevant to the transaction, a white-label robo-advisor platform can help strengthen the traditional relationship. This will also help build the trust mediators and insurers should have with their customers.

The robo-advisor platform helps policyholders to optimize their investment strategies, manage their investments, and achieve their financial goals.

5. Banking and Fintech

Robo Advisor is a digital platform that offers automated, algorithm-driven financial planning and investment services. By integrating the Robo advisor trading platform into banking and fintech, companies will transform into digital banking and investment platforms.

This platform provides personalized investment recommendations, goal-based financial planning tools, and automated financial management features, enhancing the banking experience and customer engagement.

6. Education and Student Finance

Robo Advisor trading platform is also used in education and student finance. Education institutions can build this platform to enhance their student finance management systems. It offers students personalized financial planning and investment guidance.

This platform helps students to manage student loans, saving accounts, and investment portfolios. Robo advisors allow them to make informed financial decisions and achieve financial success.

Statics of Robo Advisor Platform

Financial technology statistics have shown the amazing growth of the white-label robo-advisor platform. Have a look at the statistics of the robo-advisor platform below.

✅ The global robo-advisory market was valued at $7.9 billion in 2022; by 2032, it is projected to reach $129.5 billion.

✅ Robo-advisories could manage $2.2 trillion in assets by 2020 and $3.7 trillion by 2025, reaching over $16.0 trillion.

✅ By 2024-2028, the robo-advisor worldwide market is projected to grow by 6.68%, resulting in a market volume of US$2334.00bn in 2028.

Cost for the Development of Robo Advisor Trading Platform

After learning about the use cases of the robo-advisor trading platform, you might wonder about its development cost. The development cost of a robo-advisor platform runs between $35,000 and $150,000, but it can be more or less depending on multiple factors. We also provide a high-end and 100% customizable white-label robo-advisor trading platform with a starting rate of $7,500. Below is a table of development costs at different stages of the Robo-Advisor.

| Development Stage | Development Cost(Approx.) |

|---|---|

| Market Research | $2,000 – $10,000 |

| UI/UX Design | $5,000 – $20,000 |

| Backend Development | $10,000 – $100,000 |

| Frontend Development | $8,000 – $50,000 |

| Security & Compliance | $5,000 – $25,000 |

| Testing & Quality Assurance | $3,000 – $15,000 |

| Cloud Hosting & Services | $500 – $5,000/ Monthly |

| Third-party Services | $1,000 – $10,000 |

| Marketing & Launch | $5,000 – $50,000 |

| Legal & Administrative | $3,000 – $20,000 |

Business Benefits of the Robo Advisor Trading Platform

The provided statistics might have helped you understand how amazing it is for business growth to invest in a robo-advisor platform. Below, we have listed some business benefits of adopting a white-label robo-advisor platform.

1. Scalability of Data Management

Robo Advisor lets your business scale its investment management effortlessly and efficiently. Its automated ability enables businesses to handle a high volume of clients and manage them with little or no human intervention.

2. Brand Differentiation

The robo-advisor trading platform differentiates your business from competitors and places you as a forward-thinking, tech-driven financial service provider. This will attract more clients and demand to those seeking modern and digital investment solutions.

3. Cost Effectiveness

By developing the robo-advisor platform, businesses can provide low-cost investment solutions to their clients compared to traditional financial advisors. With an automated investment management process, businesses can eliminate human requirements and reduce overhead costs.

4. Personalization

The robo-advisor platform lets you use algorithms and data-driven insights to provide personalized investment advice. It provides portfolio guidance tailored to the client’s financial goals and risk tolerance. This will increase the client experience and satisfaction with your service.

5. Compliance and Risk Management

The robo-advisor platform has built-in compliance and risk management features to ensure regulatory compliance and reduce investment risk. This feature helps businesses follow the industry’s regulations and standards with the integration and security of clients.

6. Accessibility

Developing the robo-advisor trading platform will make investment management services more accessible to the audience with lower investment assets. This will make it easier for clients to engage with your services.

7. Data-Driven Insight

With the robo-advisor platform, businesses can gain valuable data and analytics according to clients’ preferences, investments, market trends, and portfolio preferences. This will enable your business to serve better clients and stay competitive in the market.

How to Build a Robo Advisor Trading Platform for a Business?

Robo advisor trading platform is a digital investment platform. Below is a detailed guide on how to build a robo-advisor platform for business.

1. Market Research

1. Market Research

First, do in-depth research to know the requirements and preferences of your targeted audience and competitors. You should also identify the ROI goals and make technology approximations. For this, prioritize the features you want to include, then set business goals and the technical architecture of the solutions.

2. Permission and Licensing

After market research, it is also mandatory to familiarize yourself with the financial regulations in the jurisdiction you plan to operate. This includes getting a license and ensuring the platform complies with relevant laws and standards related to investment advice, data protection, and cybersecurity.

3. Design

Now, start designing and ensure you focus on creating an intuitive and engaging user interface and experience. The designing process includes the onboarding process, portfolio management dashboard, and other user interactions with the platform.

4. Development

Once the design is completed, developing the robo-advisor trading platform is time. The development process requires each step to be followed in an agile manner. To deliver a product with optimal market benefits, following the development process agilely is necessary.

5. Security Measures and Data Protection

Implementing rigorous cybersecurity protocols to develop the robo-advisor trading platform is required, as it is necessary to protect user data and financial transactions. Security measurements and data protection include encryption, a secure authentication process, and compliance with data protection.

6. Testing and Quality Assurance

After developing a robo-advisor platform, now it’s time to test it. Rigorous testing is necessary to ensure the reliability and performance of the robo-advisor. Testing and quality assurance include testing algorithms, security vulnerability assessment, and user acceptance.

7. Deployment and Maintenance

Deployment and maintenance is the most exciting and tedious robo-advisor trading platform process. Maintenance is an ongoing process that involves monitoring the performance for issues and user engagement experience.

Sum up

Certainly, the above guide will help you understand the development of a robo-advisor platform, including its use case and cost. The robo-advisor trading platform represents an opportunity in fintech to deliver financial advice and make wealth management accessible to the audience. This robo-advisor platform software recommends the most fitting assets for the investment.

+1 315 210 4488

+1 315 210 4488 +91 798 618 8377

+91 798 618 8377