How Much Does Mobile Banking App Development Costs – When we talk about the implementation and perfect use of the technology, we can clearly observe that mobile application is one of the most successful innovations of the current. From food deliveries to medical supplies and daily essential items, each of the things is available at your fingertips with an advanced mobile application.

As per the industry experts, the market of mobile app development will grow and reach up to $1873.23 million by the end of 2030.

Some more stats:

- More than 70% of adults use mobile applications for banking-related work.

- Online baking platforms will see up to 1 billion users by the end of 2024.

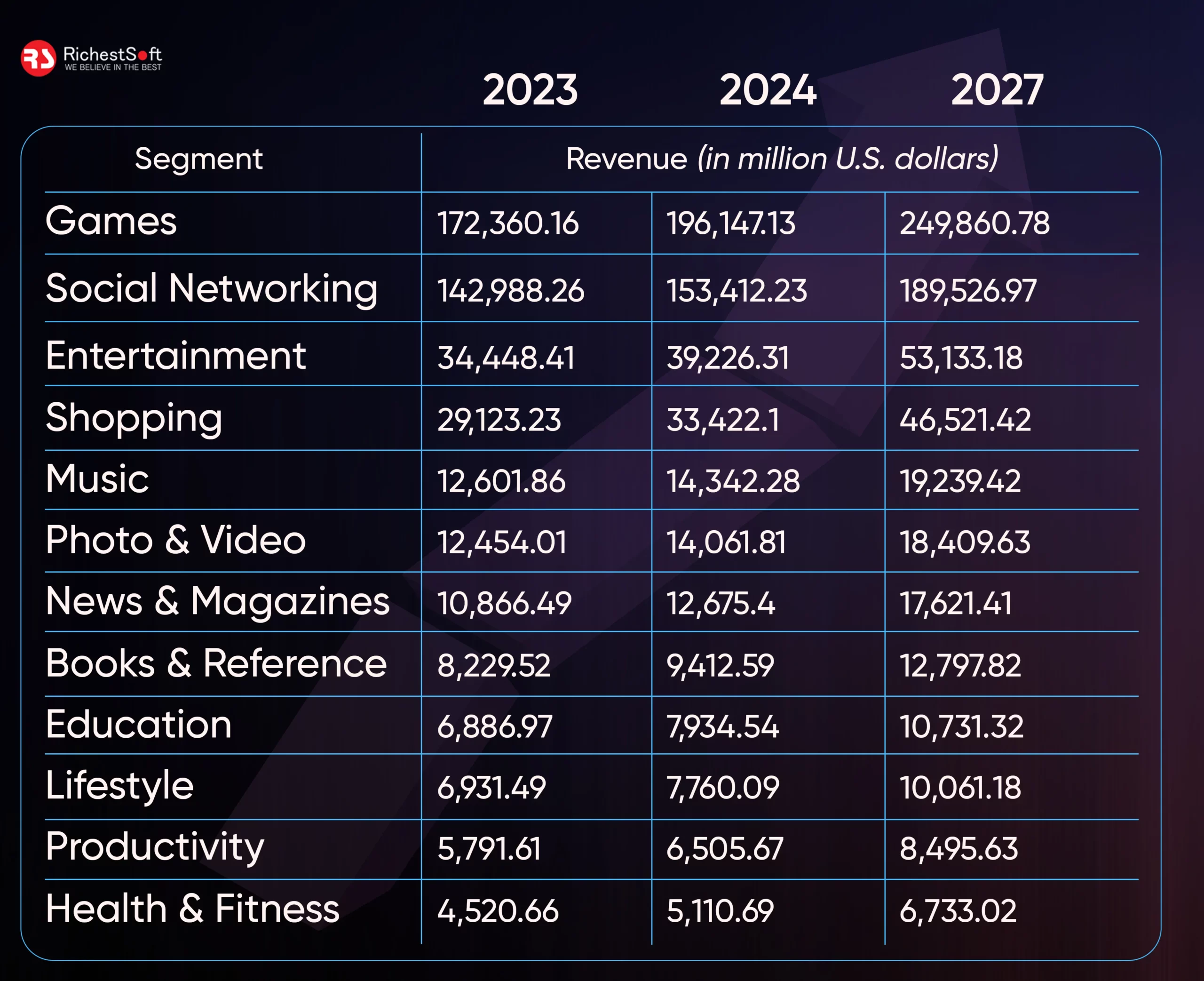

- Social networking applications are the most used application globally.

- Most of the users belong to the age slab of 18-24.

- About 90% of smartphone users use at least one application.

- An average smartphone user use on an approx 10 applications per day and 30 applications every month.

The above-mentioned stats indicate that even if a minimum number of users are using an application then also you can have a huge user base for your application.

Getting a reliable and experienced mobile app development company in US can be a crucial task for you at a cost-effective rate. Although there are various companies there are very few of them who deliver the project with perfection.

The development cost of a mobile banking application is something that you should be aware of if you are planning to build a mobile banking app. In this blog, we will break down the mobile banking app development cost.

Detailed Breakdown of Mobile Baking App Development Cost

The development cost is influenced by several factors in mobile banking applications, such as the application’s features, complexity, the size of the development company you engage in, and various other elements that impact the overall cost of development.

Here is the complete breakdown of the mobile banking app development cost:

| Mobile Banking App Type | Estimated Development Cost |

|---|---|

| Virtual Banking App | $50,000-$90,000 |

| Ai Banking App | $45,000-$85,000 |

| Blockchain-Based Banking App | $30,000-$100,000 |

| Neo Bank App | $40,000-$120,00 |

| UPI Payment App | $30,000-$65,000 |

Banking App Development Cost Based On Complexity

Another factor influencing development costs is the complexity of the application, which can be categorized into three main types: basic-level complexity applications, medium-level complexity applications, and higher-level complexity applications.

The development cost for each of these application types varies, falling within the ranges mentioned below:

| Level Of Complexity | Cost To Develop |

|---|---|

| Low-Level Complexity | $25,000 To $40,000 |

| Medium Level Complexity | $40,000-$60,000. |

| High-Level Complexity | $60,000 To $100,000 |

Location Based Banking App Development Cost

The location of the development company also impacts the development cost of mobile banking applications. According to the lifestyle of each region, the development cost of the application varies:

| Region | Hourly Costs |

|---|---|

| North America | $25-$75 |

| Europe | $50-$100 |

| Gulf Countries | $70-$120 |

| Asia | $25-$49 |

Banking App Development Cost Based on Size of The Company

Last but not least the development cost of the mobile banking application also depends on what size of the company you are hiring for the mobile banking application development.

Hire dedicated mobile app developers if you want an application that is error-free and completely accurate.

| Company Size | Cost | Manpower |

|---|---|---|

| Small Size Company | $20,000 to $ 45,000 | 50-200 |

| Mid Size Company | $50,000 to $1,00,000 | 200-1000 |

| Large Size Company | $100,000 to $1,500,000 | 1000-10,000 |

6 Essential Features Of Mobile Banking App Development

These 6 features will help your banking app to get better user engagement and will improve as the one-stop solution for users’ needs.

- Security Measures

- Account Management

- Push Notification

- QR Code

- Integration Technologies

- Easy Bill Payments

Easy Bill Payments

Keeping the features of the easy bill payment and loan repayment option will help your users to an extent. This will help your application to be the one-stop solution for the users. It will not only increase user engagement with the application but also make reliability on the application for each of the transactions and bill payments. Including the peer-to-peer transaction procedure for bill payment & loan repayment will keep the users’ data safe and secure.

Security Measures

The security of the application should be with high-end technologies. The mobile banking app not only has data but also contains information about the millions of Dollars on it. And any attempt of a cyber attack can be dangerous for the application users. Make sure to utilize the best possible technology to maintain the application’s security.

Account Management

The account management feature is the major thing that you should focus on. Most of the app engagement comes from the account management feature. You will need to keep the management features but at the same time with high-end responsiveness. On the other side, the money transaction feature of the application should also be faster, easier, and safer. Hire an experienced mobile banking app development company to get the features with complete accuracy.

Push Notifications

Keeping the feature of the push notification helps in various ways including transaction alerts, security updates, sending marketing copies with ease, etc. The push notification feature also helps in user engagement on the application.

QR Code

Implementation of the QR code for easier and faster transactions is a necessary thing to keep as a feature. The QR scan payment option has brought a revolution in banking transactions. This helps the users to make even the minimum amount of transactions easily and also keep records of each of the transactions. The QR code payment option has created a great alternative for the lengthy form-filling banking procedures.

Integrating Technologies

For mobile banking apps, staying current with evolving technology is crucial. A state-of-the-art user experience is enhanced by the integration of features like artificial intelligence (AI) for tailored financial insights, chatbots for customer service, and QR code or NFC technology for contactless payments. In the ever-changing digital market, the app remains competitive and relevant with regular upgrades that integrate new technology.

The above-mentioned features can be crucial components in your mobile banking application. But to build a reliable mobile application you will need an experienced mobile application development company.

Richesoft has been serving the mobile application development industry since 2007 and has delivered more than 500 products and has 400+ happy clients. Apart from the Android and iOS banking mobile applications we also build blockchain-based fintech solutions with advanced features and smart contracts.

Mobile Banking App Development Procedure

Let’s see what the best possible mobile banking app development procedure that will help you to plan and execute the complete development procedure.

Define Objectives

Before deciding to launch a mobile application do in-depth research on the scope, target market, features, goals of the application, and blueprint of the application. This will help you to be precise with the vision of the application.

Design User Interface

For the high-end user interface of the application use the wireframe and create a prototype of the application to have the complete idea of the user interface reliability. Take feedback and optimize the design of the application to ensure an easy and error-free UI/UX.

Implement Security Measures

Include encryption techniques, biometric login, and multi-factor authentication. Update security features frequently to protect user data and abide by rules and industry requirements.

Testing

Test the application thoroughly to make sure each of the features is working perfectly or not, any fault with the security measures, malfunctions, or performance problems. Also, test the compatibility of the application.

Launch

After you are satisfied with the application’s performance and all the other factors you can come up with the marketing of the application and enlist the application of the Google Play Store and Apple Store.

At Richestsoft you will get a 360-degree solution, from mobile banking application development to the digital marketing solution for the application. We are with a team of 200+ dedicated mobile app developers and marketing experts who can help you to highlight your product in the marketplace.

Why Choose Richestsoft For Mobile Banking App Development

Why Choose Richestsoft For Mobile Banking App Development

Skilled Developers

Rishestsoft is one of the leading mobile application service providers with 15+ years of experience in developing high-end mobile applications. Our team of skilled professionals is well versed with the advanced technologies to provide a secure and top-notch solution.

Customized Solution

We have dedicated mobile app developers who provide customized solutions to our clients. We provide tailored solutions for the unique requirements of the application and ensure that each of the features should work perfectly.

Security Encrypted

Richestsoft is committed to providing the solution with not just accuracy but complete security as well. We deploy the application with a reliable encryption method and multi-level authentication. You can trust us to get a secure and top-notch application.

Cutting Edge Solution

We provide mobile application solutions with cutting-edge technologies. With the on-demand mobile banking application we have the potential to integrate AI, face recognition, and fingerprint recognition to ensure the safety of the users’ banking details.

User Friendly Approach

As the top mobile app development service provider we make sure to provide full client satisfaction with the application and deliver the application on time with error-free features and technologies. We respect and value your time, money, and project expectations. We make sure to deliver the project with complete security and with a customer-centric approach.

Conclusion

Launching a mobile banking application with high-end features and advanced technologies will help you generate maximum revenue from the platform. Hire mobile app development experts from Richestsoft to get a user-friendly application with the integration of advanced technologies and complete security.

+1 315 210 4488

+1 315 210 4488 +91 798 618 8377

+91 798 618 8377